Financial Hardship Service Introduced for Families of Violent Crime

Ralph Kelly sees hope for crime victims facing financial hardship

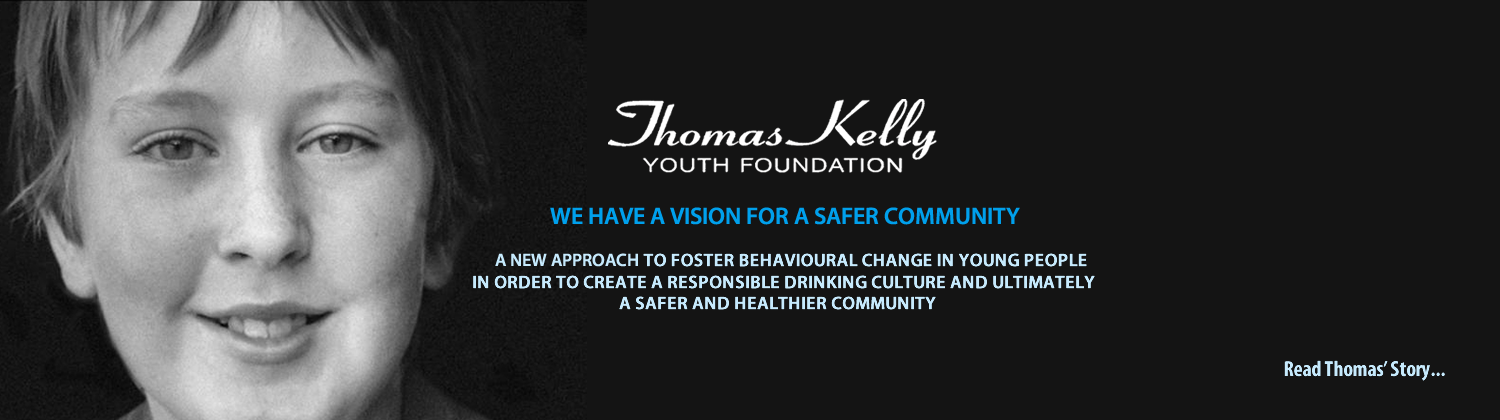

Ralph and Kathy Kelly have sat down with many victims of violent crime, listening, since their own painful loss of teenage son Thomas in a Kings Cross attack four years ago.

Amid the raw emotion and shared grief of these "awful stories", they recognised something else. Unexpected, and devastating in its own way, was the financial toll.

"I have spoken to victims and they have been on the brink of bankruptcy and would have lost everything. Their family home, everything," says Mr Kelly. "I don't think it's that uncommon. You have a trauma, you just stop. Your life stops and it is going to impact on you very heavily financially."

Many victims and their families are unable to work in the aftermath of a violent crime. But the credit card bills, mortgage repayments, utilities and rates don't stop. Life savings dissolve. Dealing with banks can be difficult at the best of times, so when life hits rock bottom, it can seem insurmountable.

"It can be as low as a council payment, something that may not seem like a lot of money, but still in the scheme of things if you are the breadwinner to the family, you are trying to juggle all of those financial liabilities at a time when you may not have income. Some people are understanding and some aren't," he says.

NSW Attorney-General Gabrielle Upton will on Sunday announce a new program of free financial counselling available to all victims of crime facing hardship as part of a wraparound service that starts with trauma counselling.

The Financial Counsellors Association of NSW (FCAN) will be trained to deal with crime victims, and take on cases referred by government agency Victims Services. Victims Services will for the first time ask about financial distress.

Mr Kelly praised the initiative: "Rather than a victim having to repeat their story, which can be an awful, awful story, to each financial institution, someone will be representing them, which will take an enormous burden and emotional stress off those families.

"Victims will be dealing one-on-one with someone who will understand, rather than dealing with an operator at the end of the phone who doesn't understand yet has a procedure, which is, 'You need to pay your bill'."

Ms Upton said the idea had grown after the Kellys raised the issue with the NSW government after their own experience following Thomas' death.

Discovering that banks offer lower interest rates to farmers in drought areas, Mr Kelly wrote to then attorney-general Brad Hazzard on behalf of the Thomas Kelly Youth Foundation, suggesting the NSW government could similarly ask the banks, credit card companies and utilities to offer lower interest rates, or a temporary payment freeze, for victims of crime.

Mr Hazzard asked, but got few responses. The banks that did write back claimed they already had hardship programs in place.

But Mr Kelly said these must be "the world's best-kept secrets", because none of the victims he knew had ever been offered assistance by a bank. "I said to the government, you don't walk into the bank and tell people what's happened to you. It's the last thing you want to do, and it's very, very difficult," Mr Kelly said.

One night he received a phone call from Mr Hazzard's successor as attorney-general, Ms Upton, who said she had seen the Thomas Kelly Youth Foundation proposal and liked it. She again wrote to financial institutions. Undeterred by the lack of response, Ms Upton looked for another way to tackle the problem. A deal was struck with the non-profit FCAN to act on victims' behalf to navigate the banks' hardship services.

"Escaping a violent and abusive relationship or being unable to work because of a trauma often puts people in a difficult spot moneywise. Access to free, independent and confidential financial counselling can be a big help," she said.

Victims Services receives 80,000 calls a year, and the NSW government expects to refer at least 3000 victims a year to financial counsellors. Mr Kelly tells the story of a young woman, who was left unable to work or drive after a violent attack, and continues to receive medical treatment, but now doesn't answer her phone because she is being hounded by debt collectors.

"She wants to pay it back but she can't," he says.

He hopes access to a financial counsellor will take away at least this burden, until victims can recover, and start to pay off their debts as they rebuild their lives.

Kirsty Needham SMH 29.5.16

Read more: http://www.smh.com.au/nsw/ralph-kelly-sees-hope-for-crime-victims-facing-financial-hardship-20160528-gp633c.html#ixzz4DlwGtWJk